26.01.2026

Hi Audrey

Thanks to you and the Finance team for your time on Friday.

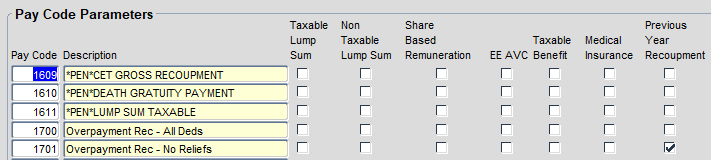

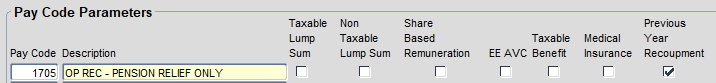

Just to reiterate, in order to ensure compliance with Revenue regulations, recoupments of overpayments should be notified to Revenue through the regular submission process. This is done through our system configuration where certain paycodes are identified as Overpayment recoupments in year/ out of year – see below

As discussed on the call, if your HR team feel it is appropriate for KWETB to make a recoupment of overpaid values on behalf of another organisation, then the only method available is to set up the regular recoupment allowance in People XD using paycode 1701 ( Overpayment rec – no relief) . This allowance can be charged to an FMS code that is easily identifiable to the finance personnel. Your Finance team would then be able to ring fence these recoupment values and arrange for the payment to be made to DoEY.

NOTE: If the overpayment value notified to KWETB is the GROSS overpayment - The payee may be entitled to some refunds on statutory deductions once the recoupment is complete. In order to facilitate that, a statement may be required from DoE to confirm the corrected positions in the years of the overpayment. Likewise, the payee may have entitlement to a refund on pension cons paid on the Overpayment, which also would need to be established by DoE.

From todays call I believe you will have further discussions with your HR team leads and perhaps the Finance team who might be able to advise further regarding expense codes etc.

Please contact the pay team directly if you decide to implement same and we can go over the details of the specific case.

Regards

Gill